IRS 944-X 2025-2026 free printable template

Instructions and Help about IRS 944-X

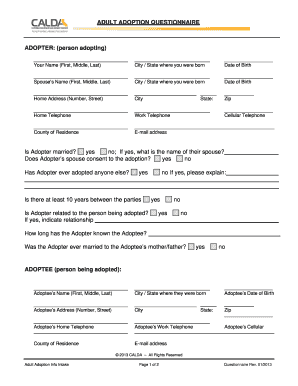

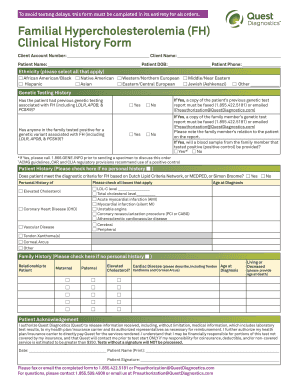

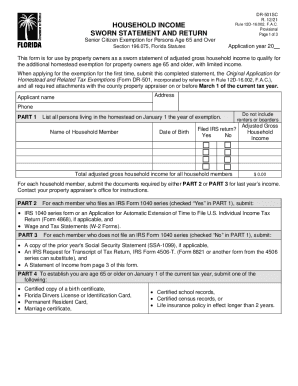

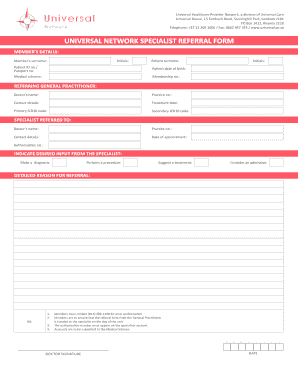

How to edit IRS 944-X

How to fill out IRS 944-X

Latest updates to IRS 944-X

All You Need to Know About IRS 944-X

What is IRS 944-X?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 944-X

What should I do if I realize I've made a mistake on my IRS 944-X after submission?

If you discover an error on your IRS 944-X after filing, you must submit an amended form to correct it. This involves filling out another IRS 944-X, ensuring that all corrections are clearly marked. Remember to include a brief explanation for each correction to help the IRS understand the changes.

How can I verify if my IRS 944-X has been received and processed?

To check the status of your IRS 944-X, you can use the IRS online tools or contact their customer service. Common rejection codes may provide insight into any issues that occurred during the processing. Make sure to keep your submission records handy for reference when checking the status.

Are there specific scenarios where nonresidents need to file IRS 944-X differently?

Nonresidents may face different regulations when filing IRS 944-X, particularly regarding the types of income reported and potential withholding requirements. It’s advisable for nonresidents to consult IRS guidelines or a tax professional familiar with international tax issues to ensure compliance with filing requirements.

What common errors should I avoid while filing the IRS 944-X?

Common mistakes when filing IRS 944-X include incorrect identification numbers, miscalculation of tax amounts, and failing to sign the form. To avoid these pitfalls, double-check all entries and ensure your calculations are accurate before submitting your form.