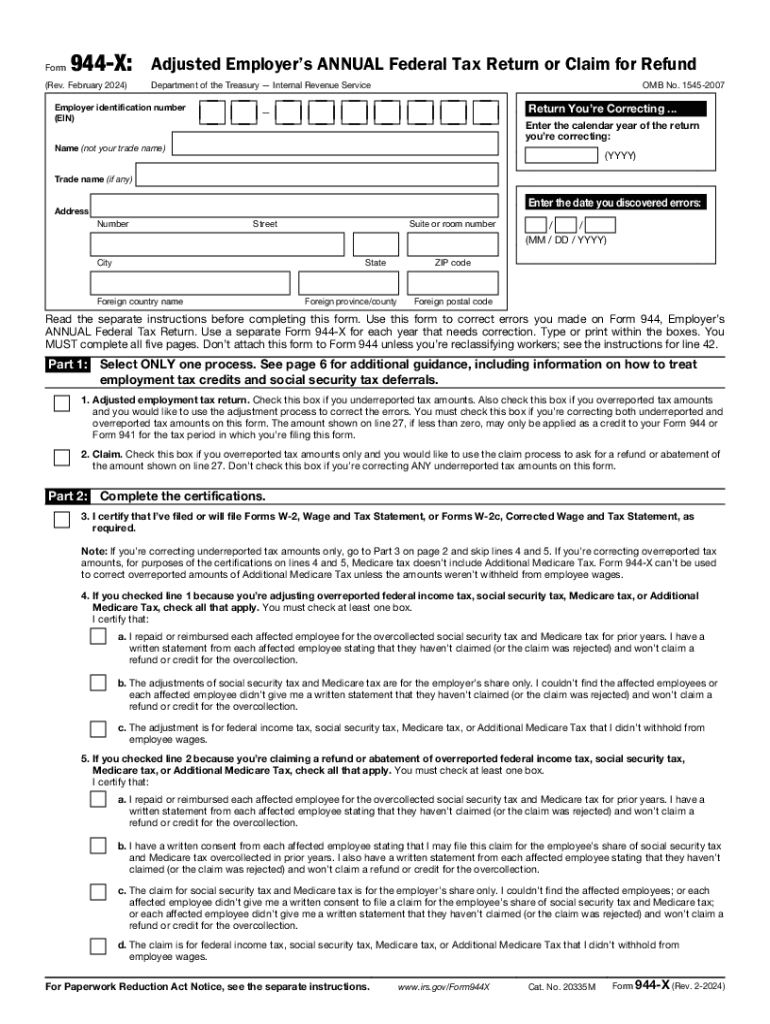

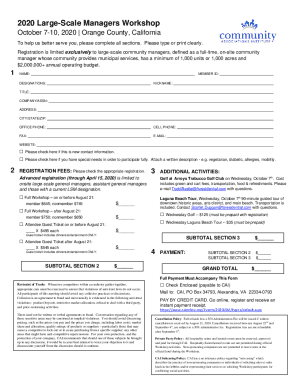

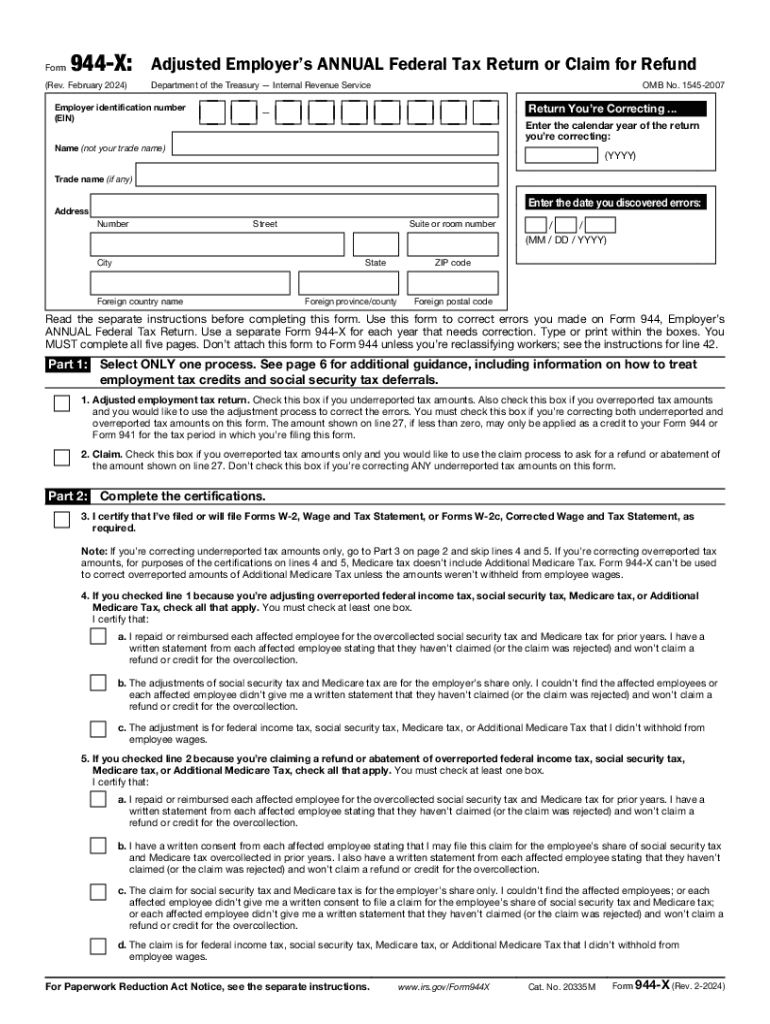

IRS 944-X 2024-2025 free printable template

Get, Create, Make and Sign federal tax return form

Editing 944 x online

IRS 944-X Form Versions

How to fill out tax refund form

How to fill out IRS 944-X

Who needs IRS 944-X?

Video instructions and help with filling out and completing 944 x form

Instructions and Help about tax irs

Let me quickly talk to you about IRS form 944 employers annual federal tax return I'm giving you a full explanation here don't go anywhere so welcome back folks to another edition of the awesome sort of kiwi show how are you today I hope you are doing fantastic I'm doing superb if you are doing as marvelous as I am go grab a cup of coffee or tea or vodka let's roll in today's conversation we will actually have a walkthrough when it comes to form 944 employers annual federal tax return what is it this form was introduced by the IRS to give smaller employers a break in filing and paying federal income tax withheld from employees as well as social security and medicare payments owed by employers and employees so employers whose annual payroll tax liability is one thousand dollars or fewer can use form 944 to file only once a year instead of quarterly and form 944 cannot be used by household employers or agricultural employers this is very important to note so what is it what is form 944 we have right now a snapshot of it on the screen you can see it right...

People Also Ask about irs adjusted federal

What is a 944x tax form?

What is the difference between a 941 and a 944?

How to fill out Form 944?

What is the 944 form used for?

Do you have to file a 944 if you have no payroll?

What taxes are 944?

What does 941 mean in taxes?

What is the difference between IRS Form 941 and 944?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax return for eSignature?

How do I complete irs form adjusted on an iOS device?

Can I edit federal tax return on an Android device?

What is IRS 944-X?

Who is required to file IRS 944-X?

How to fill out IRS 944-X?

What is the purpose of IRS 944-X?

What information must be reported on IRS 944-X?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.